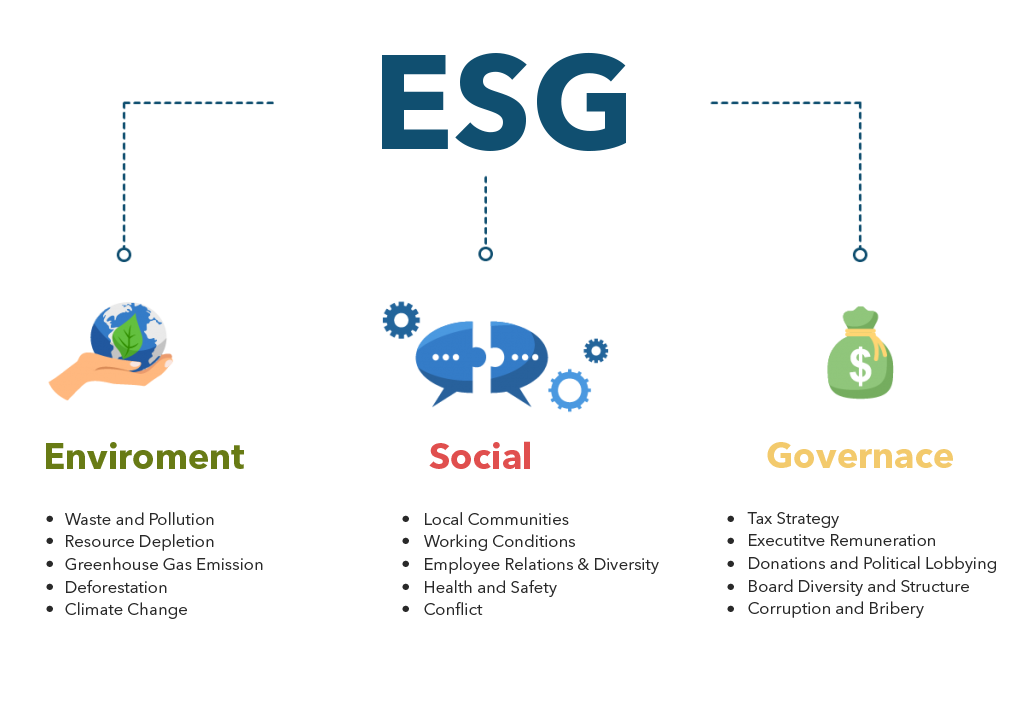

Environmental, Social, and Governance

Over recent years, investors have increasingly looked to integrate environmental, social and governance (ESG) considerations as part of their investment process. For example, in a MSCI 2021 survey of 200 institutional investors managing around $18 trillion, 73% planned to increase ESG investment and in a 2021 survey of 800 individual US investors by Morgan Stanley, 79% were focused on prioritising sustainable investing .

Reduce Risk & Manage ESG Compliance

Modern Capital ESG, you can future-proof compliance with upcoming additions and amendments to ESG-related regulations, including Sustainable Finance Disclosure Regulation (SFDR), Task Force on Climate-Related Financial Disclosures (TCFD), Corporate Sustainability Reporting Directive (CSRD) and more.

Improve Efficiencies through Increased Automation

Efficiently adopt ESG into your organization by consolidating it into Client Lifecycle Management and eliminating silos. Increased automation reduces manual rekeying of data, improving process and data accuracy.

Unlock Revenue Potential with Existing and New Clients

Modern Capital ESG enables your firm to unlock the potential to retain existing customers and attract new clients who are increasingly becoming socially and environmentally conscious in their banking and investments choices..

Environment

- Waste and pollution

- Resource depletion

- Greenhouse gas emission

- Deforestation

- Climate change

Social

- Local Communities

- Working Conditions

- Employee relations and diversity

- Health and safety

- Conflict

Governance

- Tax strategy

- Executive remuneration

- Donations and political lobbying

- Board diversity and structure

- Corruption and bribery